The Ultimate Guide To Mileage Tracker

Table of ContentsThe Greatest Guide To Mileage TrackerFascination About Mileage TrackerMileage Tracker Things To Know Before You BuyThe Buzz on Mileage TrackerThe Facts About Mileage Tracker UncoveredThe Ultimate Guide To Mileage Tracker

A web-based coordinator should be able to give you a quite accurate quote of mileage for the journey in concern. While it might look like an arduous task, the benefits of keeping an automobile mileage log are tremendous. Once you enter into the behavior of tracking your gas mileage, it will certainly become second nature to you.

Prepared to start your efficiency journey? Check out our collection of notebooks!.?. !! Portage Notebooks lies in Northeast Ohio and has been producing specialist notebooks for media, police, and organizations for over fifty years. Our notebooks are used the best quality products. If you want discovering more concerning performance, time management, or notebook company ideas, see our blog. If you have any kind of questions, do not be reluctant to reach out - email us at!.

For small company owners, tracking mileage can be a laborious however vital task, particularly when it comes to taking full advantage of tax obligation deductions and managing overhead. The days of manually recording gas mileage in a paper log are fading, as digital mileage logs have actually made the process much more reliable, exact, and convenient.

The Buzz on Mileage Tracker

One of one of the most substantial benefits of using an electronic gas mileage log is the time it saves. With automation at its core, digital devices can track your trips without calling for hand-operated input for every trip you take. Digital gas mileage logs take advantage of general practitioner innovation to immediately track the range traveled, classify the journey (e.g., service or personal), and generate thorough records.

Time-saving: Save hours of hands-on information entrance and prevent human errors by automating your mileage logging procedure. For tiny company proprietors, where time is cash, utilizing an electronic gas mileage log can substantially simplify everyday procedures and free up even more time to focus on growing the company.

Some business owners are unclear regarding the advantages of tracking their driving with a gas mileage app. In a nutshell, tracking gas mileage during service travel will help to improve your fuel efficiency. It can also aid decrease vehicle wear and tear.

The Main Principles Of Mileage Tracker

This short article will reveal the advantages related to leveraging a mileage tracker. If you run a delivery company, there check over here is a high opportunity of spending lengthy hours when driving daily. Service proprietors generally locate it difficult to track the distances they cover with their automobiles considering that they have a lot to think of.

In that situation, it means you have all the opportunity to enhance on that element of your service. When you make use of a mileage tracker, you'll be able to record your expenses much better (mileage tracker).

Gas mileage tracking plays a huge role in the lives of lots of chauffeurs, workers and firm choice makers. It's a little, each day point that can have a huge impact on individual lives and lower lines. What precisely is gas mileage tracking? What does gas mileage monitoring imply? And what makes a mileage tracker app the very best mileage tracker app? We'll damage down every one of that and extra in this message.

The Best Guide To Mileage Tracker

Gas mileage monitoring, or mileage capture, is the recording of the miles your drive for business. There are a few reasons to do so. Prior to the TCJA, W-2 employees would track Get More Info miles for tax obligation reduction. This is no much longer a choice. Many full time staff members or contract workers tape their mileage for reimbursement functions.

It is necessary to keep in mind that, while the tool utilizes general practitioners and activity sensor capacities of the phone, they aren't sharing places with employers in real time - mileage tracker. This isn't a surveillance initiative, but an easier method to capture business trips traveled properly. A free mileage capture application will certainly be hard to find by

Some Ideas on Mileage Tracker You Should Know

Mileage apps for individual drivers can cost anywhere from $3 to $30 a month. We comprehend there are a whole lot of employees out there that need an app to track their gas mileage for tax and compensation functions.

There are a significant variety of advantages to making use of a gas mileage tracker. For companies, it's internal revenue service compliance, increased exposure, reduced mileage fraud, reduced management. For professionals, it's mostly concerning tax deduction. Allow's explore these advantages better, beginning with one of one of the most important reasons to apply a mileage monitoring application: internal revenue service conformity.

Expense repayment scams represent 17% of overhead scams. Frequently, that fraudulence check here is directly connected to T&E products. Numerous companies are just unaware of the fraudulence because their processes are incapable to examine reports in an automated, effective fashion. With an automated gas mileage monitoring app, companies get GPS-verified gas mileage logs from their workers.

The Best Strategy To Use For Mileage Tracker

Automating mileage tracking improves efficiency for those in the field and those active filling up out the logs. With a gas mileage application, logs can conveniently be submitted for reimbursement and totally free up the management job of verifying all employee gas mileage logs.

Once again, specialists mostly make use of company gas mileage trackers to maintain track of their gas mileage for tax reductions. What makes the best gas mileage tracker application?

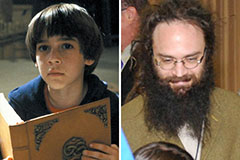

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!